How to Guide: Discover the most effective Practices for Learning Any Type Of New Ability

How to Guide: Discover the most effective Practices for Learning Any Type Of New Ability

Blog Article

Exactly How to Establish a Comprehensive Budgeting Plan to Attain Financial Security and Control Over Your Costs

Establishing a detailed budgeting plan is important for achieving financial security and maintaining control over costs. It begins with a thorough assessment of your present financial landscape, which consists of reviewing revenue and expenses. Comprehending the subtleties of this process can significantly affect your financial trajectory and way of life selections.

Evaluate Your Current Financial Scenario

To effectively create a budgeting strategy, it is essential to thoroughly evaluate your current monetary situation. It is critical to compute your total month-to-month revenue precisely, as this figure will certainly direct your budgeting choices.

Following, examine your costs by classifying them into taken care of and variable expenses. Fixed expenditures, such as lease or home loan settlements, insurance coverage, and energies, stay consistent each month. In contrast, variable expenditures, like groceries, amusement, and optional spending, can fluctuate. Maintaining an in-depth document of your investing behaviors over a couple of months can give understanding right into areas where you might be overspending.

Furthermore, consider any type of superior financial debts, consisting of bank card balances, trainee finances, and personal finances. Recognizing your responsibilities is essential for formulating a plan to take care of and reduce them properly. By conducting a comprehensive evaluation of your financial situation, you can establish a solid groundwork for your budgeting strategy, eventually resulting in enhanced monetary stability and control over your costs.

Establish Clear Financial Goals

Regularly setting clear financial objectives is important for efficient budgeting and lasting monetary success. Defining specific, quantifiable, attainable, appropriate, and time-bound (CLEVER) goals enables individuals to produce a roadmap for their monetary trip. These objectives can incorporate various aspects of individual finance, including conserving for retirement, buying a home, or repaying financial obligation.

To start, assess your concerns and recognize short-term, medium-term, and long-term objectives. Temporary goals may include constructing an emergency fund or saving for a vacation, while medium-term objectives could include conserving for an auto or funding a youngster's education (How to guide). Lasting objectives usually focus on retirement savings or wealth build-up

Following, evaluate your goals to offer quality. For instance, as opposed to intending to "save even more money," define "conserve $10,000 for a down settlement by December 2025." This level of uniqueness not only boosts motivation yet also facilitates dimension of progress.

Finally, on a regular basis testimonial and change your monetary goals as conditions transform. Life occasions such as job modifications, family growth, or unanticipated expenses can impact your economic situation, making it necessary to continue to be receptive and versatile to accomplish continual financial stability.

Create Your Spending Plan Structure

Developing a budget structure is a basic action in bringing your financial objectives to fulfillment. A well-structured budget plan framework serves as a plan for managing your earnings, costs, and cost savings, enabling you to align your costs with your economic ambitions.

Begin by categorizing your expenses right into discretionary and vital categories. Essential costs include requirements such as housing, utilities, groceries, and transportation, while discretionary expenses incorporate amusement, dining out, and deluxe items. This category aids you prioritize your spending and determine areas where modifications can be made.

Next, identify your income resources and determine your overall monthly income. This ought to consist of incomes, sideline, and any kind of passive income. With a clear image of your earnings, you can designate funds to every cost classification better.

Incorporate cost savings into your budget framework by reserving a particular percent of your earnings. This will aid you build a reserve and add to lasting financial objectives. A strong budget structure not only offers clarity on click here to find out more your economic scenario however also empowers you to make educated choices that promote monetary security and control over your expenses.

Screen and Change Routinely

Monitoring and adjusting your budget plan is important for maintaining financial health and wellness and making sure that your costs straightens with your progressing goals. On a regular basis evaluating your spending plan allows you to identify discrepancies in between your prepared expenses and real investing. This method assists you stay mindful and accountable of your monetary circumstance.

Begin by establishing a consistent timetable for spending plan reviews, whether it be weekly, regular monthly, or quarterly. This analysis can disclose patterns that necessitate adjustments in your budgeting approach.

Additionally, life changes-- such as task transitions, relocating, her comment is here or household growth-- can impact your economic landscape. Be prepared to readjust your spending plan to show these changes, ensuring it stays pertinent and effective. Bear in mind, a budget is a living record that ought to evolve with your monetary conditions. By proactively keeping an eye on and readjusting your spending plan, you can preserve control over your costs and work in the direction of achieving your financial security objectives.

Utilize Devices and Resources

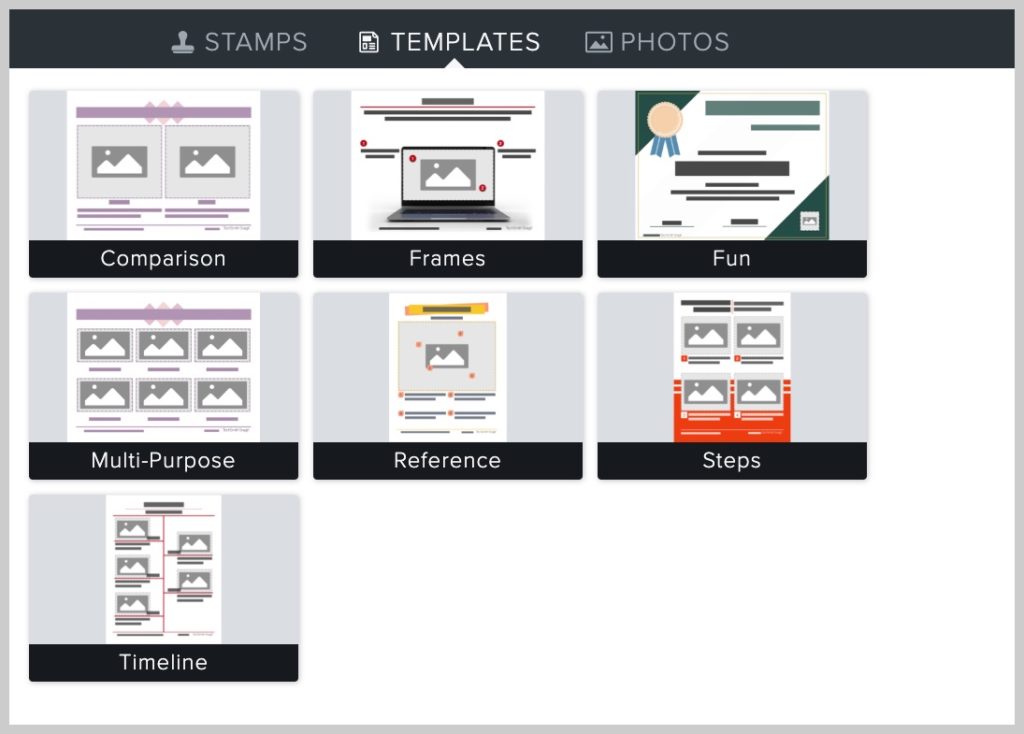

A large variety of resources and devices can dramatically enhance your budgeting procedure, making it easier to stay and track expenditures on target. Financial administration software program, such as Mint, YNAB (You Need a Spending Plan), or EveryDollar, offers easy to use user interfaces for keeping track of income and expenditures in real-time. These systems usually include automated tracking of purchases, categorization of spending, and graphical depictions of your monetary scenario, promoting educated decision-making.

Along with software application, mobile applications can offer comfort and access for budgeting on-the-go. Several applications enable the syncing of savings account, making sure exact data while providing notifies for upcoming costs or monetary restrictions.

Moreover, spread sheets, such as Microsoft Excel or Google Sheets, can be tailored to develop an individualized budgeting system. These tools allow individuals to manually input information, assess trends, and task future expenditures based on historic costs patterns.

Finally, consider leveraging instructional sources such as budgeting workshops, on the internet courses, or monetary blog sites. These sources can strengthen your understanding of efficient budgeting methods and aid you make notified choices that straighten with your economic objectives. Utilizing these devices and resources is critical in achieving monetary security and control over your expenses.

Verdict

By conducting an extensive evaluation of your monetary situation, you can develop a strong foundation for your budgeting strategy, inevitably leading to improved economic stability and control over your expenditures.

By evaluating the present financial circumstance, establishing clear monetary goals, and creating a structured spending plan framework, individuals can efficiently designate resources. Making use of economic administration tools better enhances the budgeting process, ultimately leading to boosted economic control and security.

Report this page